26+ Home equity line of credit

A home equity line of credit or HELOC for short is a form of credit that you can use for large expenseslike a home renovation. A home equity line of credit HELOC is a line of credit extended to a homeowner that uses the borrowers home as collateral.

2021 Healthcare Financial Trends Commercehealthcare

There is a 450 termination fee if you close the Line within the first.

. June 26 2008 HOME EQUITY LINES OF CREDIT Consumer Protection and Risk Management Considerations When Changing Credit Limits and Suggested Best Practices Summary. You can also make payments back toward the. The amount of credit available to you is dependent on the.

The total interest paid is 15997 for a Home Equity. 26 Typically youre only required to make interest payments during the draw period which tends to be 10 to 15 years. Your homes equity is the difference between the appraised value of your home and your current mortgage balance.

Line amount must be between 10000 and 750000. As a rule of thumb lenders will generally allow you to borrow up to 75-90 percent of your available equity depending on the lender and your credit and income. The credit is secured by your home which.

Next Up in Home Equity Best. So in the example above youd be. For example if you have a 200000 mortgage plus a 50000 home equity line of credit and your home is worth 300000 your CLTV is 83.

In some ways HELOCs function. 43 Use this calculator to determine the home equity. Lifetime maximum APR is 18.

The monthly payment is 1933 for a new Home Equity loan and 2004 for a Home Equity Line of Credit. 26 A home equity line of credit HELOC allows you to tap into your homes value to cover significant expenditures or unexpected costs. Through Bank of America you can generally borrow up to 85 of the value.

It is essentially a line of. A Home Equity Line Of Credit is a great way to use your current homes equity to ensure you have money for needed repairs and expenses. Use our home equity line of credit HELOC payoff calculator to find out how much you would owe on your home equity-based line each month depending on different variables.

Call 800-553-0880 or 408-451-9111 or check the Equity Rates Page for current rates. 10-year draw period with 15-year repayment period. A home equity line of credit is a type of second mortgage that allows homeowners to borrow money against the equity they have in their home and receive that money as a line of.

Home Equity Line Of Credit - HELOC. If your loan requires an appraisal title insurance or attorney fees they must be paid at the borrowers expense. LINE OF CREDIT AMOUNT.

The minimum loan amount for a Home Equity Line of Credit is 5000. Minimum 5000 but lines over 200000 are available and have the lowest rates. The APR will never be higher than 1800 or less than 224.

A home equity line of credit also known as a HELOC is a revolving line of credit that allows people to borrow against the equity in their homes. A home equity line of credit HELOC is a line of credit that uses the equity you have in your home as collateral.

Charts Visualizations Abi

Sec Filing Patria Investments Limited

2

2

Sec Filing Patria Investments Limited

2

Charts Visualizations Abi

Charts Visualizations Abi

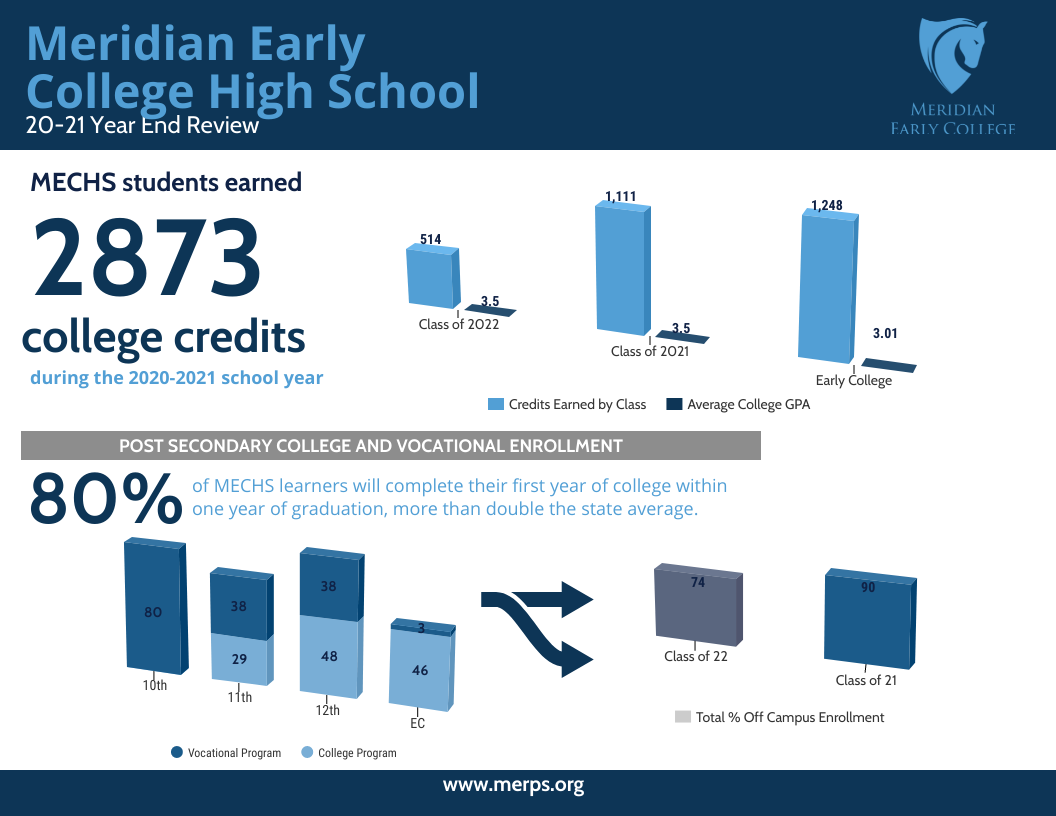

Our Data Meridian Early College High School

2021 Healthcare Financial Trends Commercehealthcare

2

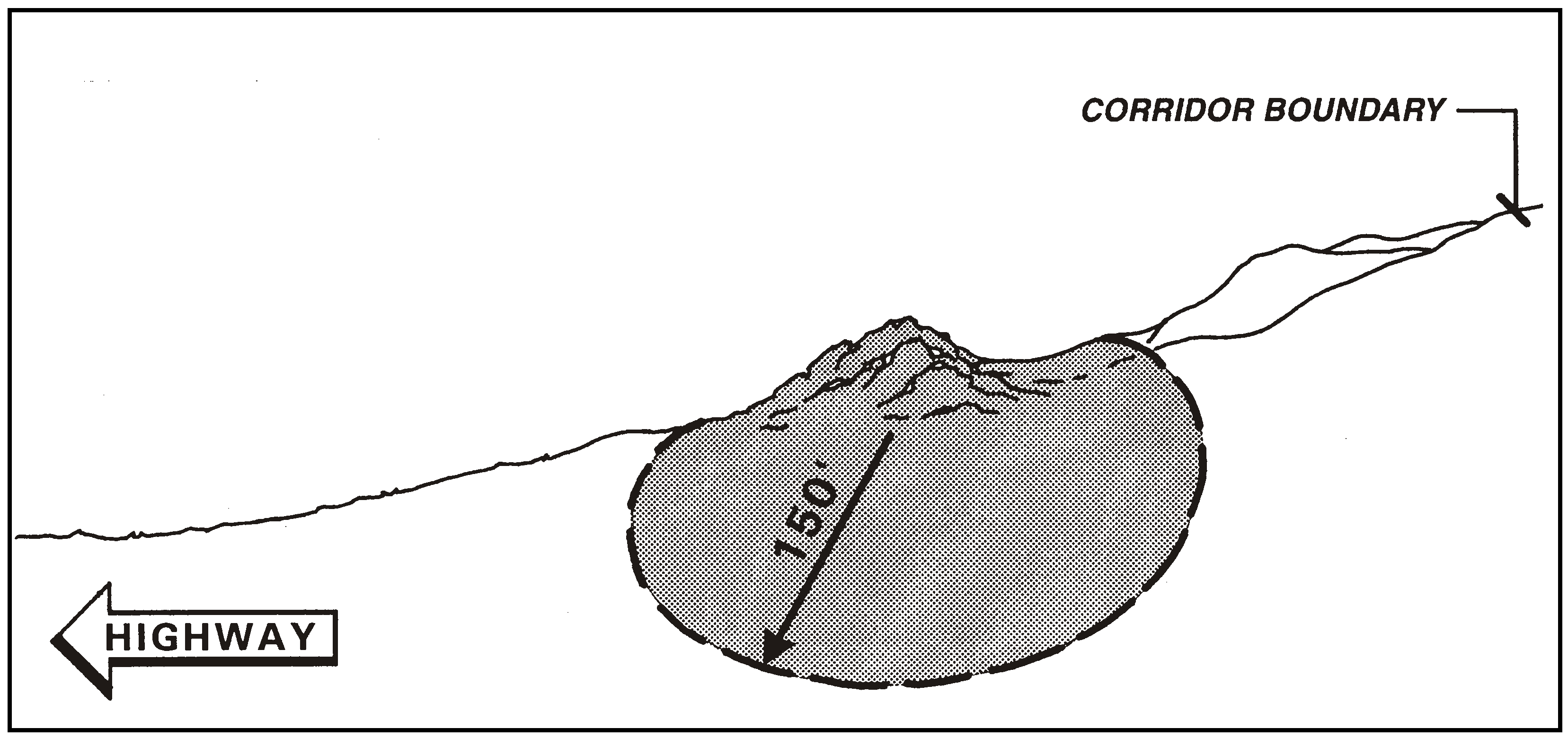

Article 3 Site Planning And Project Design Standards County Code San Luis Obispo County Ca Municode Library

Charts Visualizations Abi

Dt2peybyspdpim

2

Charts Visualizations Abi

Sec Filing Patria Investments Limited